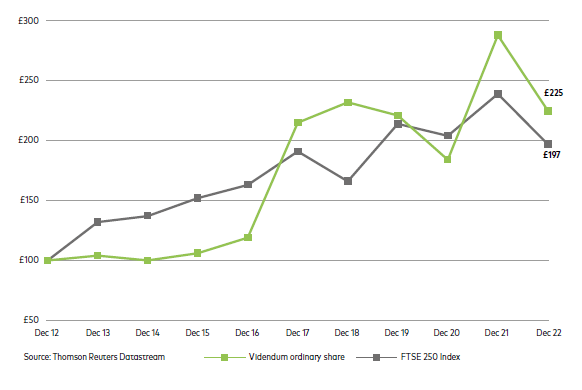

Ten-year performance graph of the Company’s ordinary shares compared to comparator group

The Company is required to include a line graph showing the Company’s ordinary share performance compared to an appropriate index over a ten-year performance period ending 31 December 2022. The graph below illustrates the Company’s annual Total Shareholder Return (“TSR”) (share price growth plus dividends that have been declared, paid and reinvested in the Company’s shares) relative to the FTSE 250 for the preceding ten-year period ending 31 December 2022, assuming an initial investment of £100. This index has been chosen since it is the comparator group (excluding financial services companies and investment trusts) for one of the performance conditions tied to awards under the LTIP. The Committee notes that the FTSE 250 Index is a recognised broad market equity index, relatively complex and international in nature and is comparable to the Company’s business operations where approximately 90% of revenues are generated outside the UK. TSR data is taken from Datastream.

*Extract from 2022 Annual Report